Stock Picks

Stocks have been a tool of many investors for hundreds of years to earn passive income. The problem with stocks is that they are slow and steady. I have owned hundreds of different stocks and it is very hard to beat the returns of the stock market. Why try to spend all that time and effort buying and selling different stocks to beat the stock market when you can just buy stock funds that track the stock market (ETF). You can make the same amount or more money with no effort babysitting your stocks. Here are some different stocks that I invest in to earn passive income.

(ETFs are Exchange Traded Funds with many different stocks in their fund)

High Yield Dividend Stocks

JEPI and JEPQ

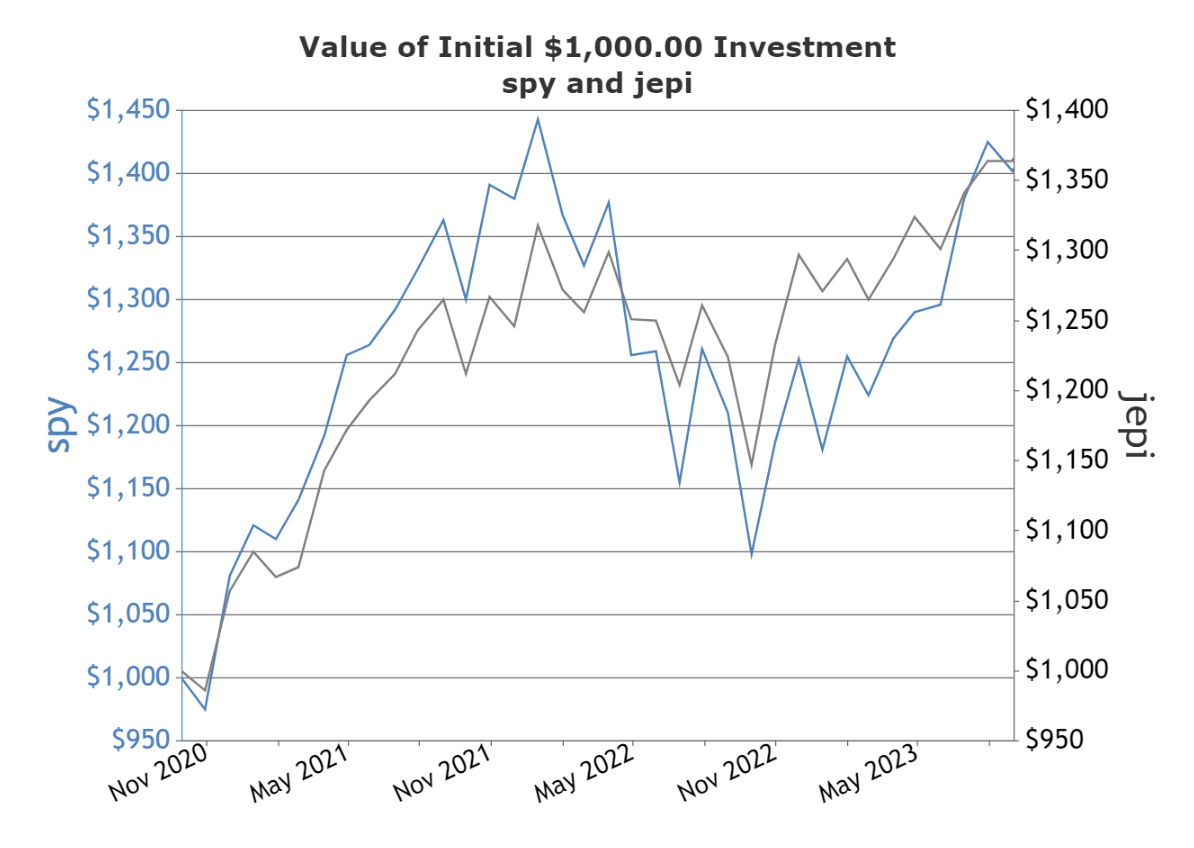

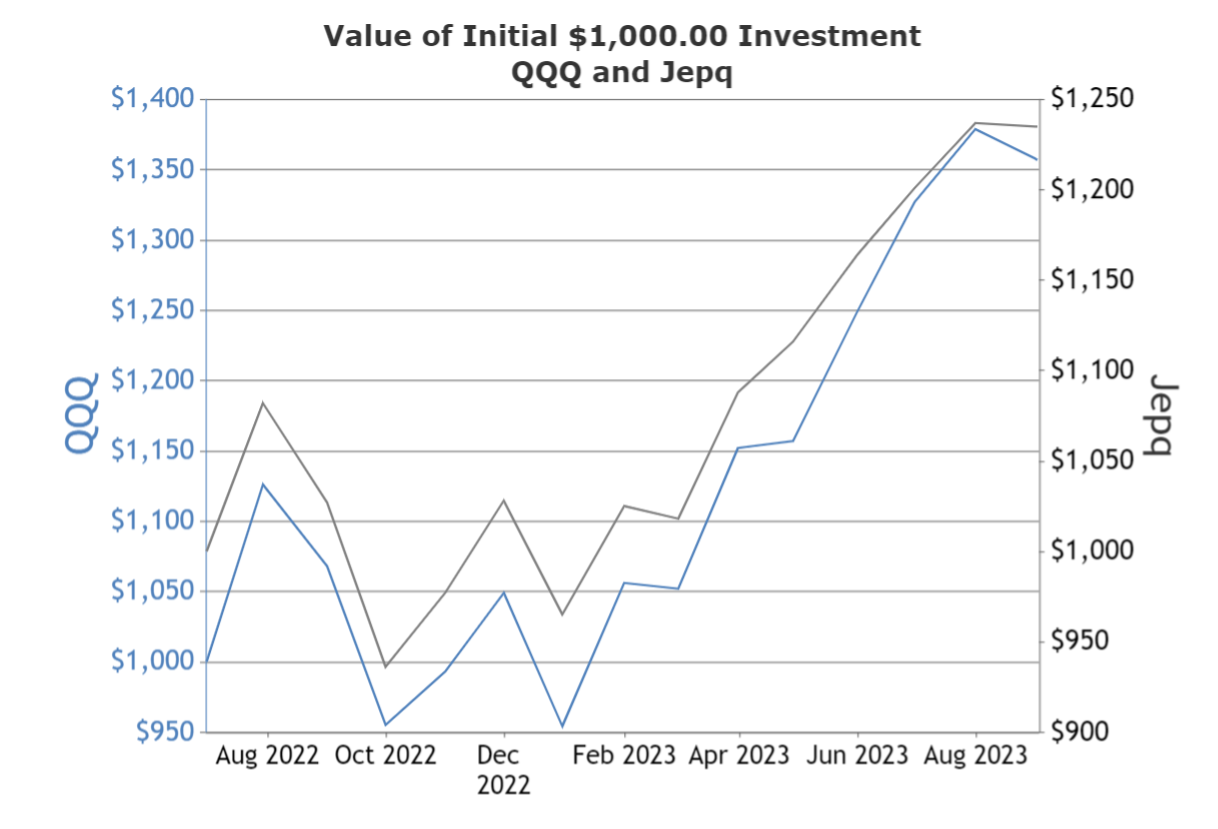

JEPI and JEPQ are both Covered Call ETFs. They focus on paying out high Dividend Yields over stock price growth. JEPI tracks the S&P 500 and JEPQ tracks the Nasdaq. Even though Covered Call ETFs don't grow as fast as normal ETFs or Stocks, they also don't go down as fast, so they can help you lose less money in a Bear Market. JEPI offers a Dividend Yield of 10.35% and JEPQ has a Dividend Yield of 11.46% (both are subject to change) and pay monthly dividends. If you invested $1,000,000 into these funds, they would be generating over $100,000 per year in dividend payments plus give you excellent growth in the stock price during Bull Markets and reduce your losses in Bear Markets. See the charts below to see the performance of JEPI vs SPY (S&P 500) and JEPQ vs QQQ (Nasdaq) They often times outperform the index fund they track.

Aggressive Triple Leveraged ETFs

Bull Market: TQQQ = 3X Growth of Nasdaq

Bear Market : SQQQ = 3X Short of Nasdaq

You can use Triple Leveraged ETFs to get 3 times the amount of growth (or loss) than you would get with normal stocks or ETFs. These ETFs can be used for big profits in Bull Markets or Bear Markets, but if you pick the wrong fund for the type of market that happens, it will increase your losses by 3 times the normal amount of losses. When you think the market is going to go up, buy TQQQ. When you think the market is going down, buy SQQQ and you can make money from the stock market going down. (Shorting the Market)

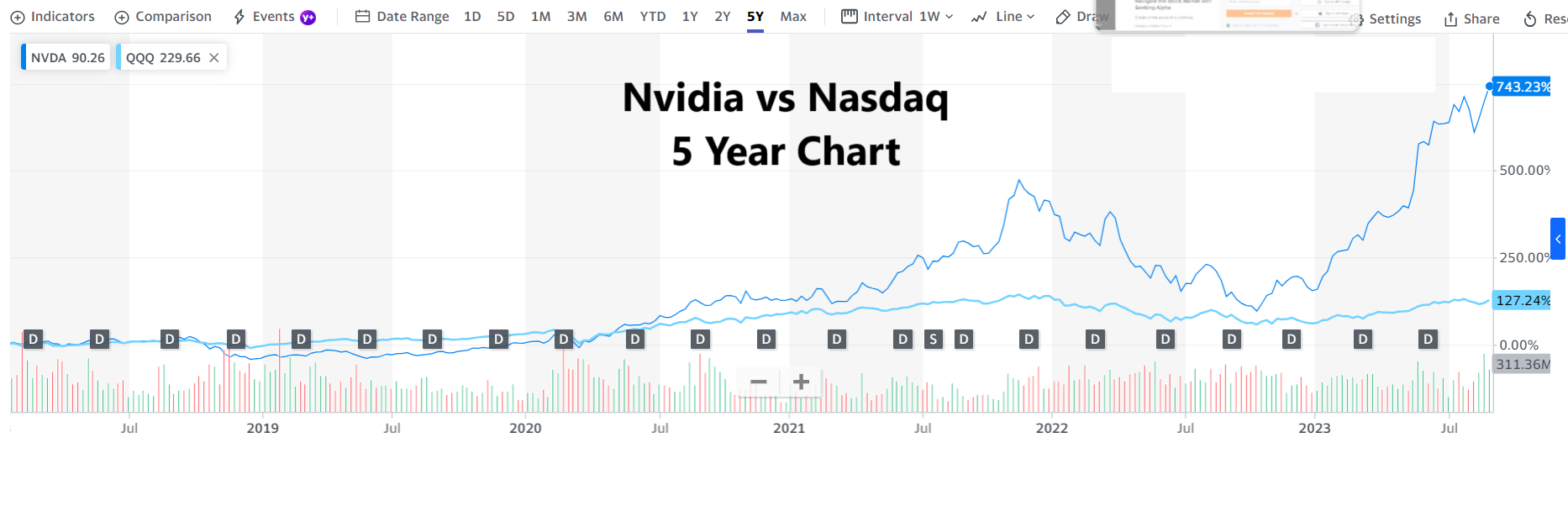

NVDA = Nvidia

Semiconductors are in high demand and the demand will only increase as our development and reliance on Artificial Intelligence increases. The individual company that has seen the biggest boost from the AI boom is Nvidia and should continue to see outstanding growth.

Tesla

Tesla has been breaking through expectations again and again with its technological advances. They are posed to take a huge lead in the self driving car and robotaxis. Tesla stock has out outperformed almost every other stock over the past few years.